After determining what states to collect sales tax in, registering your business in those states, and then setting up sales tax collection in Amazon, the last thing to do is to send what you’ve collected through Amazon to the appropriate state(s). Sending (or remitting) what you owe to the state(s) is done by filing sales tax returns (usually online) and including a payment (usually made directly from your bank account).

Sending what you owe sounds simple and straightforward, but in a lot of cases it’s not. In fact, in a lot of cases it’s a giant, time-consuming burden. Understanding why involves some background information about how the system works…

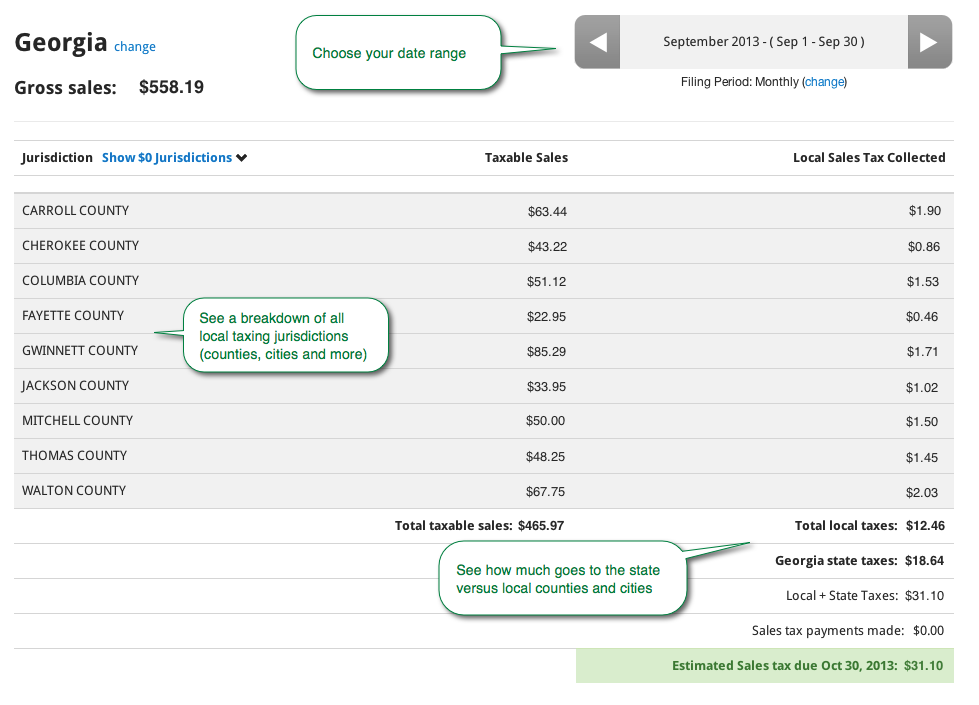

First, what most people don’t realize when they buy (or in this case sell) something online is the sales tax amount is actually a sum of as many as several different taxes all rolled into one. The sales tax collected may be part state sales tax, part county or city sales tax, and also it may be part special sales tax (like a transit or education tax).

So the states set sales tax rates but, ironically, they don’t have any way to collect the tax. Therefore they rely on you, the seller, to do it for them. They even have a cute name for you. To them you’re a ‘collection agent’. You collect the sales tax from your customers and then pass it along to the state.

Once you pay what you owe to the state, then it’s the state’s job to make sure that the money gets distributed correctly. So, for example, if you’re a seller with nexus to Washington who makes a payment to the state then it’s up to the state to make sure that all of the counties and cities you collected sales tax for get their money. And how do they know what counties and cities to pay? That’s where you, the seller, comes in. It’s your job to tell them!

And this is what makes filing sales tax returns in states like Kansas, Nevada, South Carolina, and Washington so difficult. Those states want YOU to go through the painstaking work to subtotal your sales and taxes collected by local jurisdictions. Kansas for example, has more than 800 sales tax jurisdictions. So you know what Kansas makes you do? They ask you tell tell them in which of those 800 jurisdictions did you ship items to.

You have three options to get this done.

1. Become intimately familiar with spreadsheets. Go line by line through every transaction in the states in which you have nexus, take the zip code from the ship-to address, look it up on the state website and then subtotal your sales by each jurisdiction.

2. Use AutoFile from TaxJar and save an average of 5 hours per filing (depending on your volume). When you sign up for AutoFile, we automatically calculate and file your sales tax returns for you. We even remit your payment for you so you don’t have to worry about a thing. No more poring over complicated sales tax reports or remembering you password to login and file in multiple states. Here’s how AutoFile works:

3. Even if you don’t want to use AutoFile, you can still save hours per month with TaxJar’s automated sales tax reports. Here’s a screenshot of what a typical sales tax report on TaxJar will look like.